How To Make Money In Us As An Immigrant

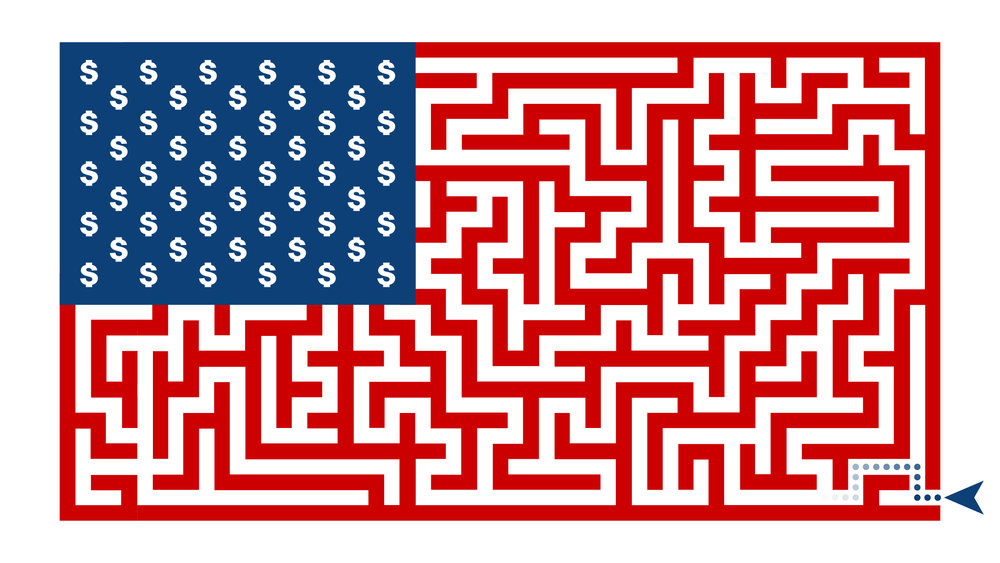

For many Americans, the financial landscape is uncertain terrain. Nosotros're worried about whether Social Security volition notwithstanding exist when we retire, saving upward for a rainy day, and financing the ballooning costs of a higher pedagogy. But for the 23.2 million known unbanked people in the U.S. the journey to economic stability is an even more hard maze. Among this population are many of the 11 million undocumented residents estimated to be in this country, including "Dreamers" or undocumented immigrants brought to the U.Southward. as children.

Despite the current political debate, almost undocumented immigrants did not get in in the U.South. illegally. Co-ordinate to the Heart for Migration Studies, 42 percent of all undocumented residents in 2014 were "overstays," those living in the U.South. on expired visas. Under the Naturalization Human action of 1952, living in the country under an expired visa isn't a crime. As of last yr, well-nigh 690,000 young immigrants were enrolled in the Deferred Activity for Babyhood Arrivals program, according to the Pew Research Middle. These DACA recipients have the legal right to work and attend school.

Merely those bare-basic legal protections don't necessarily brand life easier from a financial perspective. From trying to find a steady job (and a mode to cash paychecks) to worrying about keeping cash secure in the home, the undocumented and unbanked can spend hundreds more a year and tack on immeasurable stress trying to make do without common financial tools.

Getting a task is hard work

Finding a job is often the starting time—and biggest—fiscal hurdle undocumented residents face. Under the Immigration Reform and Control Human activity of 1986, employers can't knowingly hire undocumented workers. They're legally required to ask for documentation proving that someone is authorized to work in the U.Southward. However, if an undocumented worker is hired, the worker can't exist fired based on a failure to produce documentation later on, every bit stated in the Immigration and Nationality Human action.

Undocumented workers practise find jobs, just not peachy ones. Typically they terminate up in fields like construction, farm labor, or the service industry, essentially jobs with high turnover and employers eager to fill positions rapidly. Oft, as an Eater exposé found, workers in the service industry submit false documents while employers turn a blind heart, unable to afford the cost of verifying every employee. In some cases, employers may simply choose not to verify employees at all, opting to take the risk and pay the fine if caught.

Adina Appelbaum, an immigration chaser and founder of the website Immigrant Finance, says that most undocumented workers "are forced to take jobs nether the table, where they are more likely to face poor piece of work conditions and abuse from employers."

A recent study from the University of California, Davis and Samuel Merritt University besides found immigrant workers often find themselves in "iii-D jobs—dingy, dangerous, and demanding (sometimes degrading or demeaning)." Working longer hours for less pay, immigrant workers are some of the virtually vulnerable members of the workforce, oft facing risky environmental exposure, a lack of proper training, and insufficient condom equipment.

The undocumented as well have a greater fearfulness than simply beingness fired for speaking up nearly poor working weather—they run a risk their estranged employer retaliating past contacting immigration government or otherwise cartoon attention to their condition. Some undocumented employees may non seek handling if injured on the job for these reasons.

If undocumented workers do find themselves on the radar of U.S. Immigration and Customs Enforcement or taking a wayward employer to courtroom, their legal bills could pile upwardly fast. Appelbaum, who has worked with several undocumented residents facing displacement, says that because they don't have legal status, the undocumented don't have rights to government-appointed counsel in court, meaning they must self-fund or rely on pro-bono legal representation.

Too much greenbacks and not enough security

Fifty-fifty if the undocumented are able to discover decent employment, cashing those paychecks can exist an expensive and stressful process.

First, at that place's the linguistic communication bulwark. Native Spanish speakers made upwardly the majority of undocumented immigrants in 2016 co-ordinate to the Pew Research Center. However, a 2015 Nielsen review of the top 10 Spanish language ads among Hispanics found only 1 was for a financial establishment. And while many institutions emphasize hiring bilingual client service representatives and reaching the growing English as a Second Language population, not all branches offer those services. Things go bleaker for undocumented immigrants from other nations. While some financial institutions offer additional languages—similar Charles Schwab's Chinese-language service—many finish at Spanish, especially in smaller, local branches.

There'south likewise the upshot of bigotry. GE Upper-case letter Retail Depository financial institution was fined $169 1000000 dollars in 2014 for engaging in discriminatory practices after the depository financial institution sent out data nigh a debt-reduction program but failed to post offers to those who had indicated they wanted communications in Castilian, or who had mailing addresses in Puerto Rico. In 2017, a federal judge ruled Wells Fargo could exist sued under an anti-bigotry law from the 1800s after many DACA recipients claimed the bank denied their student loans or credit products on the basis of their immigration condition.

Undocumented residents also face an uphill battle with financial instruction and sometimes fear entering the financial system birthday. Andrew Wang, a managing partner at Runnymede Capital letter Management and a former banking company worker, recalls very few undocumented residents coming into his branch. "Because policies vary from bank to bank, the undocumented may not know the types of documents they demand to open an account," he says. "Many [banks] accept an ITIN [Individual Taxpayer Identification Number], which is available to those working legally in the U.S., including their spouses and dependents. Some even accept a passport and country of issuance."

Javier Gutierrez, a DACA recipient and founder of the website Dreamer Coin, recalls that when he was growing up, his parents rarely relied on a bank. "They had little access to financial services in Castilian, and I don't think they knew they needed them," he says.

According to Gutierrez, his parents' life in United mexican states—where corruption is mutual in many sectors—prior to arriving in the U.Due south. contributed to a general distrust of financial institutions. They "used greenbacks for everything, and they kept their savings inside of a flannel shirt in the cupboard," he says.

Keeping greenbacks savings at home presents some other kind of risk. While those with banking concern accounts can rely on loss protection to replace stolen checking business relationship funds, the unbanked oftentimes have no recourse if their money is lost or stolen, aside from going to the constabulary, which is a dicey proffer for many undocumented immigrants.

As a "Dreamer" who falls into the hazy area of undocumented, Gutierrez went a different route as a immature developed, learning the ropes of the U.S. fiscal system and securing a basic depository financial institution account. Merely he however had another hurdle to face: access to a co-operative location. "I didn't have a machine before and during college, so sometimes it was easier to cash a bank check at the gas station," he says.

Without admission to a banking company, many undocumented workers rely on check-cashing stores or outlets at businesses like gas stations to access their greenbacks. These locations are the "cheapest" options, ordinarily tacking on a per-transaction fee of upwards to $10. Payday loan fees tin go as high equally 10 percent for cheque cashing. Other offenders include big banks and some credit unions, which charge fees ranging from around an $eight flat rate to 1 percent of the check corporeality.

More than $54 billion is sent away past immigrants each year, according to The Hill. For those who send money to family unit and friends internationally, places like Western Union and MoneyGram accuse service fees that eat into their difficult-earned cash. While most fees hover effectually the $5 marking, depending on the destination they tin can also exceed $fifty.

Seeking alternatives

Though many undocumented immigrants struggle with their unbanked condition, they also find canny workarounds to become on solid financial footing, like customs-based loan groups, purchasing belongings, or starting businesses.

"Many piece of work hard to save the coin and often give information technology to their families," Appelbaum says. "They besides tend to distribute and share their money among close friends who are in demand of help, creating an breezy collective banking system."

Lending circles, where money is collected into a pool and distributed to the neediest members, help unbanked immigrants start businesses, cover financial and medical emergencies, and manage their daily lives. While many lending circles are breezy collections among family and friends or neighbors, nonprofits are likewise helping facilitate and grow lending circles into a bigger financial service.

Mission Asset Fund, based in San Francisco, provides financial literacy classes and fiscal services to immigrants and the Latino community. Over the last few years, the group has too grown its lending circle plan to mirror the benefits one might find at a traditional bank. Today, the lending circles include half-dozen to 12 people contributing toward loans of upwards to $2,400. Every month, a new member can receive a loan (ensuring everyone has a risk to participate). Loan holders repay on a monthly basis, and Mission Asset Fund reports payment information to the credit bureaus—helping recipients build their credit in the process.

The fund'due south mission isn't just to aid members find the financing they need just to assist them learn to advocate for themselves. Miguel Castillo, client success manager at Mission Nugget Fund and a DACA recipient, institute that it was important to create a level of trust amidst his clients. "Many are likewise scared to become into banks themselves," he says. "Even if I translate the fiscal jargon for them, many still don't understand why they demand to know certain aspects like credit scores or just navigating the financial system in general."

There are other methods being tested to help unbanked populations. PayPal is partnering upward with smaller banks to offering debit cards and services like directly deposit connected to PayPal accounts, which crave just your legal proper noun and an e-mail accost to register.

Gutierrez created his website specifically to assistance Dreamers navigate the complexities of the U.S. financial system. He's been able to pay off effectually $34,000 in student loan debt and believes that with the right information, others can practice the same. His site offers informative posts on building credit, choosing a banking company or credit spousal relationship, and buying a dwelling house, all targeted toward those who have temporary or uncertain immigration status.

While the current political climate has heightened incertitude around immigration, nonprofits and people like Gutierrez are helping to bring a new, brighter fiscal future for undocumented residents.

Source: https://makechange.aspiration.com/how-undocumented-immigrants-earn-and-keep-money/

Posted by: entrekinithappir.blogspot.com

0 Response to "How To Make Money In Us As An Immigrant"

Post a Comment